Early 2014, Tier One Metro – There was buzz in the city that one of the well-known schools was about to close. The school had been run and managed by a reputed educationist; it had more than a thousand kids in attendance and showed a promising growth rate. To many, this news of closure was baffling; how could it be possible?

People were curious, so they did some digging and it became evident that the school land was financed through high cost and short tenor personal loans from moneylenders, while the actual building itself was financed through a bank loan. Suddenly, it all made sense!

*****

A few years ago, a successful K-12 education group with a strong presence across multiple cities saw many senior level employees suddenly quitting. It turned out that the group was backed by a private equity fund, and while the promoters and the senior team wanted to rollout more campuses, the PE fund wanted an exit and didn’t support the plan. This resulted in the senior team packing their bags and leaving, which ultimately destroyed value for everyone.

*****

While these are only a couple of examples, they highlight that the method of financing a school project is extremely important. The right method of financing depends on the nature and stage of the business and can make or break any institution. But before we jump head-first into the right form of financing for a school, it’s important to first understand the lifecycle of a school project. There are five key phases:

Pre-Launch Phase: This is essentially the planning phase. The organization is busy finalizing the right micro-market, perfecting their “product”, getting the construction done, and launching the actual school.

Start-up Phase: This is the phase where the school is officially launched. At this point, it has gotten some admissions and is generating revenues but is not yet profitable.

Growth Phase: Once the school has become profitable, the growth phase kicks in. This is where revenue increases and we start to see sustainable profit; with each additional admission, the profitability of the school keeps increasing.

Maturity Phase: The school reaches near full capacity in the maturity phase. At this point, there is no further student admissions and no more enrolment growth. Fee growth determines the growth in revenue and profits; if the school wants to make more money, it must raise their fees.

Expansion Phase: This phase looks at expansion in capacity in order to boost sales. This usually involves adding a new campus to the overall business. Conventionally speaking, there have been two key forms of financing: Equity and Debt. However, over time, additional forms of financing have emerged; even equity and debt have been specialized.

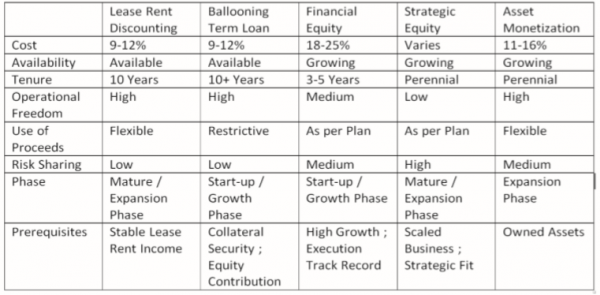

The chart below outlines some of the financing methods:

Conventional Term Loans: These loans are typically offered by banks for capital expenditure. They have equal repayments over a fixed tenure, which is typically around seven years.

Lease Rent Discount: Banks offer these loans against lease income earned by the school property company (the property company receives their income from the school). These loans have flexibility on end-use and are typically preferred during the maturity phase for new expansion projects.

Ballooning Term Loan: These are special types of term loans that are being offered to school ventures. These loans have repayment moratorium, longer tenure, and do not have equal annual principle payments.

Financial Equity: Private Equity Funds like the growing annuity model of the school business. However, given that these funds have limited life, they typically are for short duration. Because of this, typical might not work for a school project. However, increasingly many funds have realized that this business requires time and have expanded their exit horizon accordingly.

Strategic Equity: Strategic partners can bring in patient and comparatively cheaper equity capital.

Asset Monetization: School operators who own land, buildings, and other assets can monetize them to raise additional capital for the expansion and growth of the school.

Endowments / Grants: These are capital raised from alumni, students, charitable organizations, and corporates. They can be effectively be used for the school’s expansion.

The table below summarizes the forms of capital, their details, and when can each of them can be used:

To sum everything up, given the capital-intensive nature of brick-and-mortar education ventures, the decision on the right capital structure is very critical. After all, nobody would like to close a successful school or restrict expansion when there is an opportunity for growth just waiting to be taken advantage of.